NOTICE OF THE 2015ANNUAL MEETINGANDPROXY STATEMENT

3001 Summer Street

Stamford, Connecticut 06926

Notice of the 2018

Annual Meeting and

Proxy Statement

To the Stockholders:

We will hold our 20152018 annual meeting of stockholders at 9:00 a.m. on Monday, May 11, 20157, 2018 at the Hyatt Regency Hotel, 1800 East Putnam Avenue, Old Greenwich, Connecticut 06870. The Notice of Meeting and Proxy Statement and accompanying proxy card describe in detail the matters to be acted upon at the meeting.

It is important that your shares be represented at the meeting. Whether or not you plan to attend, please submit a proxy through one of the three convenient methods described in this proxy statement in order for your shares to be voted at the meeting. Your vote is important so please act at your first opportunity.

We have elected to furnish proxy materials and the Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 20142017, to many of our stockholders via the Internet pursuant to Securities and Exchange Commission rules. We urge you to review those materials as well as our proxy statement for information on our financial results and business operations over the past year. The Internet availability of our proxy materials affords us an opportunity to reduce costs while providing stockholders the information they need. On or about March 27, 2015,23, 2018, we started mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report and how to submit a proxy online along with instructions on how to receive a printed copy of the proxy statement and annual report. We provided a copy of the annual meeting materials to all other stockholders by mail or through electronic delivery.

If you receive your annual meeting materials by mail, the Notice of Meeting and Proxy Statement, Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 20142017 and proxy card are enclosed. Whether or not you plan to attend the annual meeting in person, please mark, sign, date and return your proxy card in the enclosed prepaid envelope, or submit your proxy via telephone or the Internet, as soon as possible in order for your shares to be voted at the meeting. If you received your annual meeting materials via e-mail, the e-mail contains voting instructions and links to the proxy statement and annual report on the Internet, which are also available atwww.proxyvote.com. If you decide to attend the annual meeting and wish to change your vote, you may do so by submitting a later dated proxy or by voting in person at the annual meeting. If you received your annual meeting materials via e-mail, the e-mail contains voting instructions and links to the proxy statement and annual report on the Internet, which are also available atwww.proxyvote.com.

We look forward to seeing you at the meeting.

Michael I. Roth

Non-Executive Chairman of the Board

Stamford, Connecticut

March 27, 201523, 2018

Notice of Meeting:

The annual meeting of stockholders of Pitney Bowes Inc. will be held on Monday, May 11, 2015, at 9:00 a.m. at the Hyatt Regency Hotel, 1800 East Putnam Avenue, Old Greenwich, Connecticut 06870.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on May 11, 2015:

Pitney Bowes’ 2015 Proxy Statement and Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2014, are available atwww.proxyvote.com.

The items of business at the annual meeting are:

Stockholders also will act on such other matters as may properly come before the meeting, including any adjournment or postponement of the meeting.

March 13, 2015 is the record date for the meeting.

This proxy statement and accompanying proxy card are first being distributed or made available via the Internet beginning on or about March 27, 2015.

Amy C. CornCorporate Secretary

��

TABLE OF CONTENTS

In this summary we highlight certain information contained elsewhere in this proxy statement. This is only a summary and does not contain all the information you should consider before you submit your proxy or vote. Please read the complete proxy statement and Annual Report on Form 10-K before you submit your proxy or vote.

Annual Meeting Information

| Time and Date: | Monday, May | |

| Place: | Hyatt Regency Hotel, 1800 East Putnam Avenue, Old Greenwich, Connecticut 06870 | |

| Requirements for Attending the Meeting: | Admission ticket, which is attached to your proxy card, or Notice of Internet | |

| Record Date: | March | |

| Voting: | Registered stockholders as of the record date (March |

Governance Structure and Leadership RolesImportant Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on May 7, 2018:

The board reappointed Michael Roth, an independent member of the board of directors,Pitney Bowes’ 2018 Proxy Statement and Annual Report to serve as Non-Executive Chairman of the Board in May 2014. A description of the Chairman role appears in the Board of Directors Governance Principles, which can be found on the company’s website atwww.pitneybowes.com under the caption “Our Company—Leadership & Governance—Corporate Governance.”

2014 Summary of Business Performance

In 2014, Pitney Bowes achieved significant progress against its three strategic initiatives to transform the company and unlock shareholder value by 1) stabilizing the mail business, 2) driving operational excellence, and 3) growing its business through expansion in digital commerce. During the year, the company continued its implementation of a new go-to-market strategy, divested certain business operations, and initiated a global effort to streamline the company’s back-office systems. All aspects of the company’s Digital Commerce Solutions segment grew revenue in 2014,Stockholders, including the introduction of outbound eCommerce services from the United Kingdom.

In addition, the company continued to deliver innovative physical and digital products and solutions and made significant investments in marketing in support of the transformation of our brand. One of the main goals of the re-branding effort is to update the market’s perception of the company. This is the first brand refresh since 1971 and only the third in the company’s 95 year history.

From a financial perspective:

PROXY SUMMARY

In short, 2014 was a year of significant progress for Pitney Bowes. We continue to see positive trends in our businesses and are making material progress toward unlocking the long-term value embedded in our company. For additional detail on the calculation of the financial metrics described above please refer to page 55 “Non-GAAP Measures” and corresponding table.

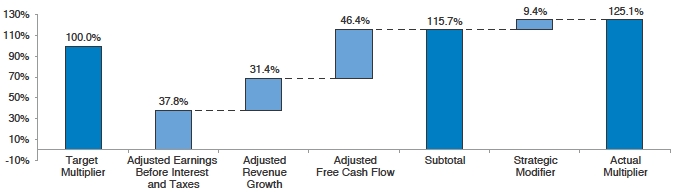

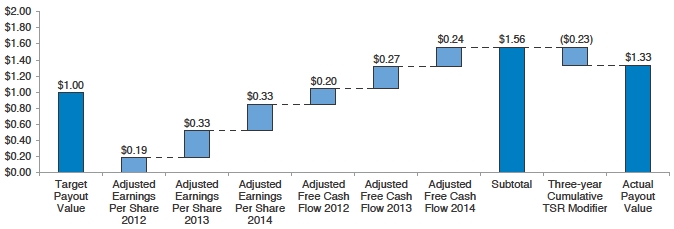

2014 Summary of Compensation Payouts

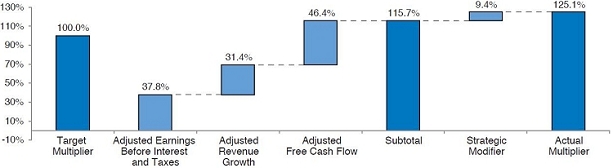

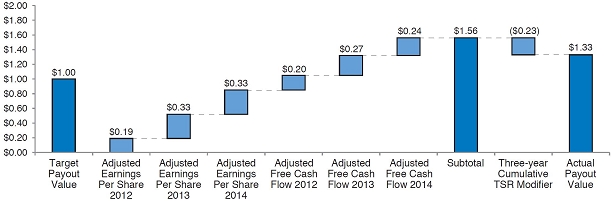

Based on the 2014 financial results summarized above when compared against the pre-determined financial goals as shown in the table below, the annual incentive payout multiplier for the named executive officers (NEOs) was 125.1% and the long-term 2012-2014 cash incentive unit award payout was $1.33 per unit.

| ||

| ||

We urge stockholders to read our Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission (SEC) on February 20, 2015, which describes our business and 2014 financial results in more detail.

PROXY SUMMARY

2014 Summary of Executive Compensation Changes2017, are available atwww.proxyvote.com.

AtThe items of business at the annual meeting in 2014, stockholders voted in favor of our executive compensation (Say-on-Pay) by over 95% of votes cast. The vote reflected stockholder approval of our compensation philosophy and pay actions as approved by the Committee in 2014 and prior years. In 2014, these actions included:are:

The 2014 changes noted above were in addition to the significant changes made to the executive compensation program during the last two years, including the following:

2014 CEO Compensation ActionsStockholders also will act on such other matters as may properly come before the meeting, including any adjournment or postponement of the meeting.

The following are highlights of 2014 compensation actions takenMarch 9, 2018 is the record date for the meeting.

This proxy statement and accompanying proxy card are first being distributed or made available via the Internet beginning on or about March 23, 2018.

Daniel J. Goldstein

Executive Vice President, and CEO as approved byChief Legal Officer & Corporate Secretary

NOTICE: Your vote is important. Brokers are not permitted to vote on any proposals to be considered at the boardmeeting except on proposal 2, ratification of directors:the Audit Committee’s appointment of the Independent Accountants for 2018, without instructions from the beneficial owner. Therefore, if your shares are held through a broker, please instruct your broker, bank or other nominee on how to vote your shares. For your vote to be counted with respect to proposals 1, 3 or 4, you will need to communicate your voting decisions to your broker, bank, financial institution or other nominee.

TABLE OF CONTENTS

| 3 |

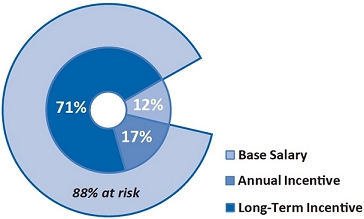

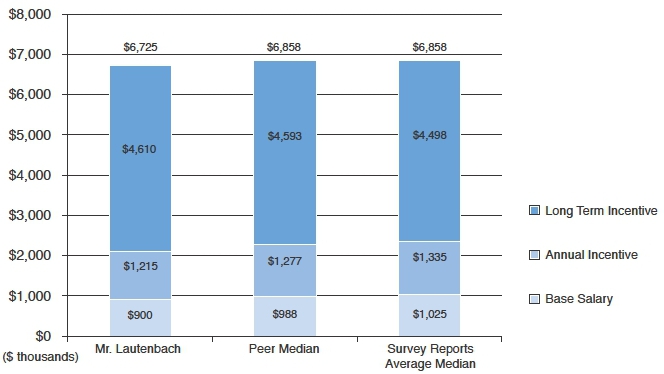

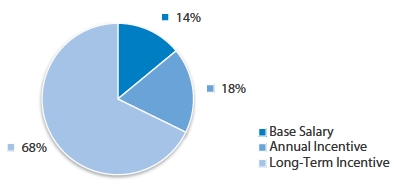

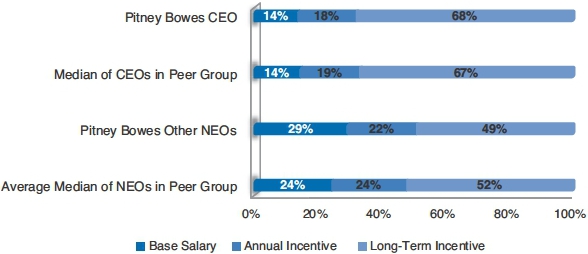

Direct Compensation Components and Mix

The overwhelming majority, 86%, of our CEO’s target total direct compensation, and 71% of target total direct compensation for the other executive officers, is variable, and is subject to financial performance metrics. In addition, more than two-thirds of the total compensation paid to our CEO, and half of the total compensation paid to the NEOs, is equity-based and aligned with shareholder interests.

Meeting Agenda Items

Proposal 1: Election of Directors

You are being asked to elect 10 directors.eleven directors, which constitute the entire board. Each of the director nominees is standing for election to a one-year term ending at the next annual meeting of stockholders in 20162019 and until his or her successor has been duly elected and qualified.

All current directors attended overat least 75% of the meetings of the board and board committees on which they served in 2014.2017.

Summary Information about our Director NomineesThe board of directors recommends that stockholders vote FOR the election of all the director nominees.

| Director Nominee | Age | Director Since | Occupation | Independent | Committees | Other Public Boards | |||||||

| Linda G. Alvarado | 63 | 1992 | President and CEO, Alvarado Construction, Inc. | X | •Finance •Governance | 3M Company | |||||||

| Anne M. Busquet | 65 | 2007 | Principal, AMB Advisors, LLC | X | •Executive Compensation •Governance | Medical Transcription Billing Corp., InterContinental Hotels Group PLC | |||||||

| Roger Fradin | 61 | 2012 | Vice Chairman, Honeywell International Inc. | X | •Audit •Finance | MSC Industrial Direct Co., Inc. | |||||||

| Anne Sutherland Fuchs | 67 | 2005 | Consultant to private equity firms | X | •Audit •Executive Compensation | Gartner, Inc. | |||||||

| S. Douglas Hutcheson | 58 | 2012 | CEO, Laser, Inc. | X | •Audit •Finance | InterDigital, Inc. | |||||||

| Marc B. Lautenbach | 53 | 2012 | President and CEO, Pitney Bowes Inc. | X | •Executive | Campbell Soup Company | |||||||

| Eduardo R. Menascé | 69 | 2001 | Co-Chairman, The Taylor Companies | •Executive •Executive Compensation** •Governance | John Wiley & Sons Inc., Hill-Rom Holdings, Inc., Hillenbrand, Inc. | ||||||||

| Michael I. Roth* | 69 | 1995 | Chairman and CEO, The Interpublic Group of Companies, Inc. | X | •Audit •Executive** •Finance** | Ryman Hospitality Properties Inc., The Interpublic Group of Companies, Inc. | |||||||

| David L. Shedlarz | 66 | 2001 | Retired Vice Chairman, Pfizer Inc. | X | •Audit** •Executive •Finance | Teachers Insurance and Annuity Association, TheHershey Company | |||||||

| David B. Snow, Jr. | 60 | 2006 | Chairman and CEO, Cedar Gate Technologies, Inc. | X | •Executive •Executive Compensation •Governance** | — |

PROXY SUMMARY

Proposal 2: Ratification of the Audit Committee’s Appointment of the Independent Accountants for 20152018

The board is asking stockholders to ratify the selection of PricewaterhouseCoopers LLP as our independent accountants for 2015.2018.

The board of directors recommends that stockholders vote FOR the ratification of PricewaterhouseCoopers LLP as our independent accountants for 2018.

Proposal 3: Non-binding Advisory Vote to Approve Executive Compensation

The board is asking stockholders to approve, on ana non-binding advisory basis, the compensation of the named executive officers as disclosed in this proxy statement. The board has determined to hold this advisory vote on an annual basis. The next advisory vote will beis expected to take place at the 20162019 annual meeting of stockholders.

The board of directors recommends that stockholders vote FOR the approval of executive compensation on an advisory basis.

Proposal 4: Approval of the Pitney Bowes Inc. 2018 Stock Plan

The board is asking stockholders to approve the Pitney Bowes Inc. 2018 Stock Plan (the “2018 Stock Plan”). The 2018 Stock Plan will govern grants of stock-based awards to employees and authorize a maximum of 14,000,000 shares, in addition to any shares associated with outstanding awards under prior plans that cease to be subject to such awards. Any shares authorized but not awarded under our current 2013 Stock Plan will be extinguished under the 2013 Stock Plan upon approval of the 2018 Stock Plan.

The board of directors recommends that stockholders vote FOR the proposal to approve the Pitney Bowes Inc. 2018 Stock Plan.

Our board of directors is soliciting proxies to be used at the annual meeting of stockholders to be held on May 11, 2015,7, 2018, at 9:00 a.m. at the Hyatt Regency Hotel, 1800 East Putnam Avenue, Old Greenwich, Connecticut 06870, and at any adjournment or postponement of the meeting. This proxy statement contains information about the items being voted on at the annual meeting.

An admission ticket, which is required for entry into the annual meeting, is attached to your proxy card if you hold shares directly in your name as a registered stockholder. If you plan to attend the annual meeting, please submit your proxy but keep the admission ticket and bring it to the annual meeting.

If your shares are held in the name of a bank, broker or nominee and you plan to attend the meeting, you must present proof of your ownership of Pitney Bowes stock as of the record date (such as a bank or brokerage account statement) to be admitted to the meeting.

If you have received a Notice of Internet Availability of Proxy Materials (a “Notice”), your Notice is your admission ticket. If you plan to attend the annual meeting, please submit your proxy, but keep the Notice and bring it to the annual meeting.

Stockholders also must present a form of photo identification, such as a driver’s license, in order to be admitted to the annual meeting.No cameras, recording equipment, large bags, or packages will be permitted in the annual meeting. Many cellular phones have built-inbuiltin cameras, and, while these phones may be brought into the annual meeting, neither the camera functionnor the recording functions may not be used at any time.

Each stockholder may appoint only one proxy holder or representativeFor directions to attend the meeting, on his or her behalf.you may contact our Investor Relations, Pitney Bowes Inc., 3001 Summer Street, Stamford, Connecticut 06926.

Who is entitled to vote?Outstanding Shares and Vote Entitlement

Record stockholdersEach share of Pitney Bowes common stock has one vote. In addition, we have two classes of preferred stock issued and outstanding: the 4% Preferred Stock and the $2.12 convertible preferencePreference Stock. The 4% Preferred Stock can be converted into 24.24 shares of common stock in certain events but does not carry any voting rights. As of March 9, 2018 (the record date), there were twelve shares of the 4% Preference Stock outstanding. The $2.12 Preference Stock can be converted into 16.53 shares of common stock in certain events and each share of the $2.12 Preference Stock carries with it 16.53 votes. Record holders of the common stock and the Preference Stock at the close of business on the record date of March 13, 2015 (the record date)9, 2018 can vote at the meeting. As of the record date, 201,666,157187,103,143 shares of Pitney Bowes common stock, and 20,056

15,590 shares of the $2.12 convertible preference stockPreference Stock were issued and outstanding. Each stockholder has one vote for each shareIf converted into common stock, the twelve shares of 4% preferred stock would be converted into 290 shares of common stock owned as of the record date, and 16.53 votes for each sharestock. The 15,590 shares of $2.12 convertible preference stock owned asPreference Stock can be converted into 257,702 shares of the record date.common stock.

If you are a registered stockholder which means you hold shares in your name, you may choose one of three methods to grantsubmit your proxy to have your shares voted:

Alternatively, you may attend the meeting and vote in person.

If you hold your shares through a broker, bank, trustee or other nominee, you are a beneficial owner and should refer to instructions provided by that entity on voting methods. Please note that if you are a beneficial owner and you wish to vote in person at the meeting, you must first obtain a legal proxy issued in your name from the broker, bank, trustee or other nominee that holds your shares.

May I revoke my proxy or change my vote?

If you are a registered stockholder, you may revoke your proxy or change your vote at any time before your proxy is voted at the meeting by any of the following methods:

Attendance at the meeting alone will not revoke your proxy.

If you hold your shares through a broker, bank, trustee or other nominee, you are a beneficial owner and should refer to instructions provided by that entity on how to revoke your proxy or change your vote.

The holders of shares representing a majority of the votes entitled to be cast at the annual meeting constitutes a quorum. If you submit your proxy by Internet, telephone or proxy card, you will be considered part of the quorum. Abstentions and broker non-votes are included in the count to determine a quorum.

| 6 |

GENERAL INFORMATION

What vote is required for a proposal to pass?

If a quorum is present, director candidates receiving the affirmative vote of a majority of votes cast will be elected. Proposals 2, 3 and 34 will be approved if a quorum is present and a majority of the votes cast by the stockholders are voted for the proposal.

GENERAL INFORMATION

You may vote “for”, “against” or “abstain” with respect to each of the proposals presented. A vote “for” will be counted in favor of the proposal or respective director nominee and a vote “against” will be counted against each proposal or respective nominee.

Your broker is not permitted to vote on your behalf on any proposals to be considered at the meeting including the election of directors and the advisory vote to approve executive compensation, except on proposal 2, the ratification of the selection of PricewaterhouseCoopers LLP as independent accountants for 2015,2018, unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your stock via telephone or the Internet. If you do not own your shares of record, for your vote to be counted with respect to proposals 1, 3 or 3,4, you will need to communicate your voting decisions to your broker, bank, financial institution or other nominee.

Under New York Stock Exchange rules, if your broker holds your shares in its “street” name, the broker may vote your shares in its discretion on proposal 2 if it does not receive instructions from you.

If your brokerdoes nothave discretionary voting authority and you do not provide voting instructions, or if you abstain on one or more agenda items, the effect would be as follows:

Proposal 1: Election of Directors

Broker non-votes and abstentions would not be votes cast and therefore would not be counted either for or against. As a result, broker non-votes and abstentions will have no effect in the election of directors.

Proposal 2: Ratification of Audit Committee’s Appointment of the Independent Accountants for 20152018

If you choose to abstain in the ratification of the Audit Committee’s selection of the independent accountants for 2015,2018, the abstention will have no effect.effect on the ratification of the Audit Committee’s selection of the independent accountants for 2018.

Proposal 3: Non-binding Advisory Vote to Approve Executive Compensation

The vote to approve executive compensation is an advisory vote and the results will not be binding on the board of directors or the company.Company. The board of directors will review the results and take them into consideration when making future decisions regarding executive compensation. Broker non-votes and abstentions wouldare not beconsidered votes cast and therefore wouldwill not be counted either for or against. As a result, broker non-votes and

abstentions will have no effect on the advisory vote to approve executive compensation.

Proposal 4: Approval of the Pitney Bowes Inc. 2018 Stock Plan

Broker non-votes are not considered votes cast and therefore will not be counted either for or against this proposal. With respect to abstentions, for purposes of approval under our By-laws, abstentions are not considered votes cast and therefore will not be counted either for or against; however, for purposes of approval under New York Stock Exchange rules, abstentions are treated as votes cast, and, therefore, will have the same effect as an “against” vote.

How do Dividend Reinvestment Plan participants or employees with shares in the 401(k) plans vote by proxy?

If you are a registered stockholder and participate in our Dividend Reinvestment Plan, or our employee 401(k) plans, your proxy includes the number of shares acquired through the Dividend Reinvestment Plan and/or credited to your 401(k) plan account.

Shares held in our 401(k) plans are voted by the plan trustee in accordance with voting instructions received from plan participants. The plans direct the trustee to vote shares for which no instructions are received in the same proportion (for, against or abstain) indicated by the voting instructions given by participants in the plans.

Broadridge Financial Solutions, Inc. (Broadridge) will tabulate the votes and act as Inspector of Election.

Want more copies of the proxy statement? Getting too many copies?

Only one Notice or, if paper copies are requested, only one proxy statement and annual report to stockholders including the report on Form 10-K are delivered to multiple stockholders sharing an address unless one or more of the stockholders giveprovide contrary instructions to us contrary instructions. or, if applicable, to your bank or broker. This process is commonly referred to as “householding”.

You may request to receive a separate copy of these materials, either now or in the future, and we will promptly deliver the requested materials.

Similarly, any stockholder currently sharing an address with another stockholder but nonethelessyou may request to receive a separate copy of these materials in the future, or if you are receiving separatemultiple copies, of the materialsyou may request delivery of a single copy in the future.

Requests can be made to:

Broadridge Householding Department by phone at 1-800-542-10611-866-540-7095 or by mail to:

Broadridge Householding Department

51 Mercedes Way

Edgewood, New York 11717.

If you own shares of stock through a bank, broker trustee or other nominee, please notify that entity if you no longer wish to participate in householding and would prefer to

| 7 |

GENERAL INFORMATION

receive more than onea separate copy of thethese materials, please contact that entityor if you are receiving duplicate copies of these materials and wish to eliminate duplicate mailings.have householding apply.

Additional copies of our annual report to stockholders, including the report on Form 10-K or the proxy statement will be sent to stockholders free of charge upon written request to:

Investor Relations, Pitney Bowes Inc.

3001 Summer Street

Stamford, CT 06926-0700.

Want Electronic Delivery of the Annual Report and Proxy Statement?

We want to communicate with you in the way you prefer. You may receive:

GENERAL INFORMATION

If you received the Notice of Internet Availability of Proxy Materials or a full set of annual meeting materials by mail, you may choose to receive future annual meeting materials electronically by following the instructions when you vote online or by telephone. With electronic delivery, you will receive an e-mail for future meetings listing the website locations of these documents and your choice to receive annual meeting materials electronically will remain in effect until you notify us that you wish to resume mail delivery of these documents. If you hold your Pitney Bowes stock through a bank, broker, trustee or other nominee, you should refer to the information provided by that entity for instructions on how to elect this option. This proxy statement and our 20142017 annual report may be viewed online atwww.proxyvote.comwww.pitneybowes.com.

GENERAL INFORMATION

Stockholder Proposals and Other Business for the 20162019 Annual Meeting

If a stockholder wants to submit a proposal for inclusion in our proxy material for the 20162019 annual meeting, which is scheduled to be held on Monday, May 9, 2016,6, 2019, it must be received by the corporate secretaryCorporate Secretary by the close of business on November 28, 2015.23, 2018. Also, under our By-laws, a stockholder can present other business at an annual meeting, including the nomination of candidates for director, only if written notice of the business or candidates is received by the corporate secretaryCorporate Secretary no earlier than the close of business on January 12, 20167, 2019 and no later than the close of business on February 11, 2016.6, 2019. However, in the event that the date of the 20162019 annual meeting is more than 30 days before or more than 60 days after the anniversary of our 20152018 annual meeting, then the stockholder’s notice must be delivered no earlier than the close of business on the 120th day prior to the meeting and no later than the close of business

on the later of the 90th day prior to the meeting or, if the first public announcement of the date of the annual meeting is less than 100 days prior to the date of such meeting, the 10th day after the first public announcement of the meeting date. There are other procedural requirements in the By-laws pertaining to stockholder proposals and director nominations. The By-laws are posted on our Corporate Governance website atwww.pitneybowes.comunder the caption “Our Company—Our Leadership & Governance—Corporate Governance.” If notice of a matter is not received within the applicable deadlines or does not comply with the By-laws, the chairman of the meeting may refuse to introduce such matter. If a stockholder does not meet these deadlines, or does not satisfy the requirements of Rule 14a-4 of the Securities Exchange Act of 1934, the persons named as proxies will be allowed to use their discretionary voting authority when and if the matter is raised at the annual meeting.

We encourage stockholders to visit our Corporate Governance website atwww.pitneybowes.comunder the caption “Our Company—Our Leadership & Governance—Corporate Governance” for information concerning governance practices, including the Governance Principles of the Boardboard of Directors,directors, charters of the committees of the board, and the directors’ Code of Business Conduct and Ethics. Our Business Practices Guidelines, which is the Code of Ethics for employees, including our Chief Executive Officer (CEO) and Chief Financial Officer,our named executive officers (NEOs), is also available on our Leadershipat “Our Company—Corporate Responsibility—Values & Governance website.Ethics.” We intend to disclose any future amendments or waivers to certain provisions of the directors’ Code of Business Conduct and Ethics or the Business Practices Guidelines on our website within four business days following the date of such amendment or waiver.

Investor Outreach.It is our practice to contact many of our stockholders over the course of the year to discuss governance issues, and to seek their views on various governance topics and executive

compensation matters. In the spring of 2014,2017, we reached out to holders ofstockholders representing approximately 43%49% of outstanding company shares, and in late 2014,the fall 2017, we reached out to holders ofstockholders representing approximately 46%51% of outstanding company shares. We value the feedback we receive concerning the board’s leadership structure, governance practices, the company’s proxy statement, executive compensation, and emerging governance trends.and executive compensation. With those stockholders who responded to our invitation in the fall of 2017, we discussed corporate governance practices, executive compensation policies and our approach to the board’s role in risk mitigation oversight, including its oversight of our cybersecurity efforts. Our investors generally have provided positive feedback on these topics, and this year our investors suggested that we continue to review our compensation and rewards programs to attract and retain top talent. Refer to section Stockholder Engagement—Executive Compensation on page 46 for further details regarding Investor Outreach.

| 8 |

GENERAL INFORMATION

Key Corporate Governance Practices Enhancing the Board’s Independent

Leadership, Accountability and Oversight

| • | Separate Chairman and |

| • | Independent |

| • | Executive |

| • | Majority Voting in Director |

| • | Annual Election of |

| • | Stock Holding |

| • | No Hedging or |

| Annual Assessments.Every year, the full board, as well as each board committee, conducts a self-assessment to evaluate all aspects of the board or board committee, including the members of the board and the board’s leadership. Each committee as well as the full board reviews and discusses the self-assessments and implements any appropriate action. In some years, the board engages a third party advisor for assistance in the self-assessment, as it did in 2016. The third-party advisor provides feedback in separate discussions with the full board and the Governance Committee as well as in individual discussions with the Chairman and with the Chair of the Governance Committee. |

Effective December, 2012, theThe board of directors has separated the roles of Chairman and CEO. The board appointed Michael I. Roth, an independent director, asis our Non-Executive Chairman of the board of directors andlast reappointed him to this roleby the board for an additional one-year term in May 2014 for a term of one year.2017. The board of directors believes it should have the flexibility to establish a leadership structure that works best for the company at a particular time, and it reviews that structure from time to time, including in the context of a change in leadership. The board believes that its current leadership structure best serves the objective of effective board oversight of management at this time and allows our CEO to focus primarily on the operations and management of the company, while leveraging the experience of the Non-Executive Chairman to lead the board.

In 2012,addition to his responsibilities in chairing the meetings of the board decided that, since the responsibilitiesand of the Lead Director, which wasFinance and Executive Committees, Mr. Roth’s role prior to his appointment

as Non-Executive Chairman, were similar in most respects to those ofRoth is a Non-Executive Chairman, the electionmember of the new CEO wasAudit Committee and attends most of the meetings of the two committees on which he is not a member. Mr. Roth is also actively involved as an appropriate timeadvisor to separate the roles ofChief Executive Officer through frequent conversations, bringing to bear his experiences as a CEO and Chairman.his experiences from his service on other boards.

The board of directors has established well-defined responsibilities, qualifications and selection criteria with respect to the Chairman role. This information is set forth in detail in the Governance Principles of the Board of Directors, which can be found on our website atwww.pitneybowes.comunder the caption “Our Company—Our Leadership & Governance—Corporate Governance.”

| 9 |

CORPORATE GOVERNANCE

Management Succession Planning

Among the board’s most important responsibilities is to oversee short and long-term succession planning and leadership development. As part of this process, the Governance Committee oversees long-term and short-term plans for CEO succession. The board of directors is responsible for evaluating the performance of the CEO and for selection of successors to that position. The criteria used when assessing the qualifications of potential CEO successors include, among others, strategic vision and leadership, operational excellence, financial management, executive officer leadership development, ability to motivate employees, and an ability to develop an effective working relationship with the board. The Governance Principles of the Board of Directors, which are posted on the company’s website atwww.pitneybowes.comunder the caption “Our

“Our Company—Our Leadership &

Governance—Corporate Governance,” include additional information about succession planning.

In late 2012, the board used the succession planning process described above to plan for the succession from our former CEO to the hiring of our new President and CEO, Mr. Lautenbach, and to the appointment of a new Non-Executive Chairman of the board, Michael I. Roth.

Periodically, but not less than annually, the board of directors considers management’s recommendations concerning succession planning for senior management roles other than the role of CEO. As part of this process, the board reviews development plans to strengthen and supplement the skills and qualifications of internal succession candidates.

As a result of these processes, the company announced several senior management changes in 2017. These are discussed in the Compensation Discussion & Analysis (CD&A) section beginning on page 39.

Board Composition, Skills and Experience Review, and Board Succession Planning

The Governance Committee periodically updates and reviews the skills and types of experience that should be represented on the board of directors in light of the company’s current business needs and future strategy. The Committeecommittee then compares these desired skills and experiences to those which current board members possess to determine whether all the identified skills and experience are sufficiently represented on the board. Based upon its review, and on its discussion with the chief executive officer,CEO, the Committeecommittee may recommend to the board that additional expertise is advisable. The Committeecommittee would then develop for the board’s consideration a skillskills and experience profile to be used in identifying additional board candidates as appropriate.

Directors are elected to terms of one year. It is the board’s policy that a director may not serve on the board later than the date of the Annual Stockholders Meeting following his or her attainment of age 72.

The board believes that, in planning for board succession, it is advisable to maintain a board that includes both experienced directors with extensive knowledge of the company’s businesses, as well as newer directors who can refresh the board’s collective experience and expertise as business needs require. The board, as well as each of its committees, circulates to its members on an annual basis, a performance assessment questionnaire. The results of the assessment are reviewed by the respective committees, with a view toward taking action to address issues presented. The Governance Committee assesses the contributions of each director annually, and determines the skill set required for new members joining the board. The average tenure of our board members is approximately 12 years.

Pitney Bowes’ Governance Principles provide for directors to retire from the board at the annual meeting fol-

lowing reaching the age of 72. Both Eduardo Menascé and Michael Roth are 72. The Governance Committee (other than Mr. Menascé) and then all of the independent directors of the board (other than Mr. Menascé) have asked Mr. Menascé, the chair of the Compensation Committee, to serve on the board for one additional year at which point Mr. Menascé will retire from the board. The other independent directors reached this conclusion in light of the company’s ongoing transformation and the need to consider whether any changes in the compensation plans are appropriate during this transformation. The other independent directors thus deemed it in the best interest of the company to ask Mr. Menascé to stay on the board and remain chair of the Compensation Committee for one additional year. In addition, the Governance Committee and then all of the independent directors (other than Mr. Roth) asked Mr. Roth to continue to serve on the board and as Non-Executive Chairman of the board. The other independent members of the board reached this conclusion based upon their view that Mr. Roth is a strong and effective leader for the board. This view has been consistently articulated in the outside assessment done for the board in 2016 and the self-assessment the board conducted in the middle of 2017. Given the company’s ongoing, significant transformation efforts, the other independent board members concluded that it is in the best interest of the company to maintain continuity in the chairmanship role. Going forward, the Governance Committee and the other independent board members will evaluate on an annual basis whether it remains in the best interest of the company for Mr. Roth to continue to serve on the board.

Role of the Board of Directors in Risk Oversight

The board of directors is responsible for oversight of the risk assessment and risk management process. Management is responsible for risk management, including identification and mitigation planning. The company established an enterprise risk management process to identify, assess, monitor and address risks across the entire company and its business operations. The description, assessments, mitigation plan and status for

each enterprise risk are developed and monitored by management, including management “risk owners” and an oversight management risk committee.

TheBoth the Audit Committee is responsible for overseeing and reviewingthe entire board review on an ongoing basis the structure of the company’s enterprise risk management program, including the overall process by which management identifies and

CORPORATE GOVERNANCE

manages risks. As part of this review, the board regularly provides feedback to management on its view of ways to continually improve the program. Upon the recommendation of the Governance Committee, the board of directors assigns oversight responsibility for each of the enterprise-wide risks to either a specific committee of the board, or to the full board. The board and each committee, with the exception of the Executive Committee, are responsible for oversight of one or more risks. The assignments are generally made based upon the type of enterprise risk and the linkage of the subject matter to the responsibilities of the committee as described in its charter or the nature of the enterprise risk warranting review by the full board. For example, the Finance Committee oversees risks relating to liquidity, and the Audit Committee over-

seesoversees risks relating to cybersecurity. internal controls and the Executive Compensation Committee reviews risk analyses relating to the company’s compensation programs. With respect to cybersecurity, members of management from multiple disciplines in the company, including Information Technology, Research and Development, Legal and Privacy, and Internal Audit provide a detailed overview to the full board of the company’s cybersecurity efforts. Under its Charter, the Audit Com-

mittee has oversight of the enterprise risks relating to Information Technology function generally, and cybersecurity in particular.

Each enterprise risk and its related mitigation plan is reviewed by either the board of directors or the designated board committee on an annual basis. On an annual basis, the board of directors receives a report on the status of all enterprise risks and their related mitigation plans.

Management monitors the risks and determines, from time to time, whether new risks should be considered either due to changes in the external environment, changes in the company’s business, or for other reasons. Management also determines whether previously identified risks should be combined with new or emerging risks.

In addition to the formal components of the enterprise risk management program, management explicitly discusses risks with the board within the context of other topics, such as the company’s and individual unit strategies and specific aspects of the company’s current transformation efforts.

The board of directors conducts an annual review of the independence of each director under the New York Stock Exchange listing standards and our standards of independence, which are set forth in the Governance Principles of the Board of Directors available on our website atwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance.” In making these determinations, the board of directors considers, among other things, whether any director hasor the director’s immediate family members have had any direct or indirect material relationship with Pitney Bowes or its management, including

current or past employment with Pitney Bowes

or its independent accountants by the director or the director’s immediate family members.accountants.

Based upon its review, the board of directors has concluded in its business judgment that the following directors are independent: Linda G. Alvarado, Anne M. Busquet, Roger Fradin, Anne Sutherland Fuchs, S. Douglas Hutcheson, Eduardo R. Menascé, Michael I. Roth, Linda S. Sanford, David L. Shedlarz, and David B. Snow, Jr.

Marc B. Lautenbach is not independent because he is a Pitney Bowes executive officer.

Communications with the Board of Directors

Stockholders and other interested parties may communicate with the Non-Executive Chairman of the board via e-mail at boardchairman@pb.com, the Audit Committee chair via e-mail at audit.chair@pb.com or they may write to one or more directors, care of the Corporate Secretary, Pitney Bowes Inc., 3001 Summer Street, Stamford, CT 06926-0700.

The board of directors has instructed the corporate secretaryCorporate Secretary to assist the Non-Executive Chairman, Audit Committee chair and the board in reviewing all electronic and written communications, as described above, as follows:

| (i) | Customer, vendor or employee complaints or concerns are investigated by management and copies are forwarded to the Chairman; |

| (ii) | If any complaints or similar communications regarding accounting, internal accounting controls or auditing matters are received, they will be forwarded by |

| the |

| to the Audit Committee chair for review and copies will be forwarded to the Chairman. Any such matter will be investigated in accordance with the procedures established by the Audit Committee; and | ||

| (iii) | Other communications raising matters that require investigation will be shared with appropriate members of management in order to permit the gathering of information relevant to the directors’ review, and will be forwarded to the director or directors to whom the communication was addressed. |

Except as provided above, the corporate secretaryCorporate Secretary will forward written communications, as appropriate to the full board of directors, or to any individual director or directors to whom the communication is directed unless the communication is threatening, illegal or similarly inappropriate.directors. Advertisements, solicitations for periodical or other subscriptions, and other similar communications generally will not be forwarded to the directors.

| 11 |

CORPORATE GOVERNANCE

Board Committees and Meeting Attendance

During 2014,2017, each director attended at least 75% of the total number of board meetings and meetings held by the board committees on which he or she served. The board of directors met eightten times in 2014,2017, and the independent directors met in executive session, without any member of management in attendance, sevennine times. MembersEach member of the board of directors serveserves on one or more of the five standing committees described below. As the need arises, the board may establish ad hoc committees of the board to consider specific issues. Mr. Lautenbach is a member of the Executive Committee.

The members of all other board committees are independent directors pursuant to New York Stock Exchange independence standards. Each committee of the board operates in accordance with a charter. The members of each of the board committees, and the number of meetings for each committee in 2017, are set forth in the following chart.chart below.

It is the longstanding practice and the policy of the board of directors that the directors attend the annual meeting of stockholders. All directors then serving on the board attended the May 20142017 annual meeting.

CORPORATE GOVERNANCE

| Name | Audit | Executive | Executive Compensation | Finance | Governance | ||||||

| Linda G. Alvarado | X | X | |||||||||

| Anne M. Busquet | X | X | |||||||||

| Roger Fradin | X | X | |||||||||

| Anne Sutherland Fuchs | X | X | |||||||||

| S. Douglas Hutcheson | X | X | |||||||||

| Marc B. Lautenbach | X | ||||||||||

| Eduardo R. Menascé | X | Chair | X | ||||||||

| Michael I. Roth | X | Chair | Chair | ||||||||

| David L. Shedlarz | Chair | X | X | ||||||||

| David B. Snow, Jr. | X | X | Chair | ||||||||

| Number of meetings in 2014 | 6 | 0 | 6 | 5 | 3 | ||||||

| Executive | |||||||||||

| Name | Audit | Executive | Compensation | Finance | Governance | ||||||

| Linda G. Alvarado | X | X | |||||||||

| Anne M. Busquet | X | X | |||||||||

| Roger Fradin | X | X | |||||||||

| Anne Sutherland Fuchs | X | X | |||||||||

| S. Douglas Hutcheson | X | X | |||||||||

| Marc B. Lautenbach | X | ||||||||||

| Eduardo R. Menascé | X | Chair | X | ||||||||

| Michael I. Roth | X | Chair | Chair | ||||||||

| Linda S. Sanford | X | X | |||||||||

| David L. Shedlarz | Chair | X | X | ||||||||

| David B. Snow, Jr. | X | X | Chair | ||||||||

| Number of meetings in 2017 | 7 | 0 | 7 | 4 | 4 | ||||||

The Audit Committee monitors our financial reporting standards and practices and our internal financial controls to confirm compliance with the policies and objectives established by the board of directors and oversees our ethics and compliance programs. The committee appoints independent accountants to conduct the annual audits, and discusses with our independent accountants the scope of their examinations, with particular attention to areas where either the committee or the independent accountants believe special emphasis should be directed. The committee reviews the annual financial statements and independent accountant’s report, invites the independent accountant’s recommendations on internal controls and on other matters, and reviews the evaluation given and corrective action taken by management. It reviews the independence of the independent accountants and approves their fees. It

also reviews our internal accounting controls and the scope and results of our internal auditing activities, and

submits reports and proposals on these matters to the board. The committee is also responsible for overseeing the process by which management identifies and manages the company’s risks. The committee meets in executive session with the independent accountants and internal auditor at each committee meeting.

The Audit Committee also has oversight over the information technology function, cybersecurity risks as well as compliance generally. The Audit Committee regularly discusses cybersecurity with leaders of the technology, information security, privacy and audit functions.

The board of directors has determined that the following members of the Audit Committee are “audit committee financial experts,” as that term is defined by the SEC: S. Douglas Hutcheson, Michael I. Roth and David L. Shedlarz. All Audit Committee members are independent as independence for audit committee members is defined inunder the New York Stock Exchange standards.and SEC standards for Audit Committee independence.

The Executive Committee can act, to the extent permitted by applicable law and the company’s Restated Certificate of Incorporation and its By-laws, on matters concerning management of the business which may arise between scheduled board of directors meetings and as described in the committee’s charter. The committee meets on an ad hoc basis when circumstances necessitate.

| 12 |

CORPORATE GOVERNANCE

Executive Compensation Committee

The Executive Compensation Committee (“Committee”) is responsible for our executive compensation policies and programs. The committeeCommittee chair frequently consults with, and the committeeCommittee meets in executive session with, Pay Governance LLC, its independent compensation consultant. The committeeCommittee recommends to all of the independent directors for final approval policies, programs and specific actions regarding the compensation of the CEO and the Chief Operating Officer (COO), and approves the

same for all of our other executive offi-

cers.officers. The committeeCommittee also recommends the “Compensation Discussion and Analysis” for inclusion in our proxy statement, in accordance with the rules and regulations of the SEC, and reviews and approves stock grants and other stock-based compensation awards. All Executive Compensation Committee members are independent as independence for compensation committee members is defined in theunder New York Stock Exchange and SEC standards.

CORPORATE GOVERNANCE

The Finance Committee reviews our financial condition and capital structure, and evaluates significant financial policies and activities, oversees our major retirement programs, advises management and recommends financial action to the board of directors. The committee’s duties include monitoring our current and projected financial condition, reviewing and recommending for board

approval quarterly dividends, share repurchases,

and other major investment decisions including financing, mergers and acquisitions, divestitures and overseeing the financial operations of our retirement plans. The committee recommends for approval by the board of directors the establishment of new retirement and post-retirement benefit plans and any amendments that materially affect cost, benefit coverages, or liabilities of the plans.

The Governance Committee recommends nominees for election to the board of directors, recommends membership in, and functions of, the board committees, reviews and recommends to the board of directors the amount and form of compensation to non-employee members of the board, and oversees CEO and senior management succession planning. The Governance Principles of the Board of Directors, which are posted on our website atwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance,” include additional information about succession planning. The committee reviews and evaluates the effectiveness of board administration and its governing documents, and reviews and monitors company programs and policies relating to directors. The committee reviews related-person transactions in accordance with company policy.

The Governance Committee generally identifies qualified candidates for nomination for election to the board of directors from a variety of sources, including other board members, management and stockholders. The committee also may retain a third-party search firm to assist the committee members in identifying and evaluating potential nominees to the board of directors.

Stockholders wishing to recommend a candidate for consideration by the Governance Committee may do so by writing to: c/o Corporate Secretary, Pitney Bowes Inc., 3001 Summer Street, Stamford, CT 06926-0700. Recommendations submitted for consideration by the committee must contain the following information: (i) the name and address of the stockholder; (ii) the name and address of the person to be nominated; (iii) a representation that the stockholder is a holder of our stock entitled to vote at the meeting; (iv) a statement in support of the stockholder’s recommendation, including a

description of the candidate’s qualifications; (v) information regard-

ingregarding the candidate as would be required to be included in a proxy statement filed in accordance with the rules of the SEC; and (vi) the candidate’s written, signed consent to serve if elected.

The Governance Committee evaluates candidates stockholders recommend based on the same criteria it uses to evaluate candidates from other sources. The Governance Principles of the Board of Directors, which are posted on our Corporate Governance website atwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance,” include a description of director qualifications. A discussion of the specific experience and qualifications the committee identified for directors and nominees may be found under “Director Qualifications” on page 2319 of this proxy statement.

If the Governance Committee believes that a potential candidate may be appropriate for recommendation to the board of directors, there is generally a mutual exploration process, during which the committee seeks to learn more about the candidate’s qualifications, background and interest in serving on the board of directors, and the candidate has the opportunity to learn more about the company, the board, and its governance practices. The final selection of the board’s nominees is within the sole discretion of the board of directors.

Alternatively, as referenced on page 128 of this proxy statement, stockholders intending to nominate a candidate for election by the stockholders at the meeting must comply with the procedures in Article I, Section 5 of the company’s By-laws. The By-laws are posted on our Corporate Governance website atwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance.”

| 13 |

CORPORATE GOVERNANCE

The Governance Committee assesses the contributions of each director annually, and determines the skill set for any new board members. Each committee also conducts an annual self-assessment of its performance.

The board also periodically hires an outside advisor to conduct an independent review of board effectiveness, as it did so in 2016.

Role of Governance Committee in Determining Director Compensation

In accordance with the Governance Principles of the Board,board, the Governance Committee reviews and recommends to the board of directors the amount and form of compensation to non-employee members of the board of directors. The Governance Committee reviews the director compensation policy periodically and may consult from time to time with a compensation consultant, to be selected and retained by the committee, as to the competitiveness of the program.

The non-employee directors’ compensation program, including the amended and restated Directors’ Stock

Plan, was last revised and approved by the stockholders effective in May 2014. The compensation for the board of directors had last been modified in 2007. In 2013,At that time, the Governance Committee retained an independent compensation consultant with no other company business, Farient Advisors, to assist in its review of the director compensation program. Farient provides no other consulting services to the company.

CORPORATE GOVERNANCE

Farient presented a recommendation to the Governance Committee for changes to the board of directors compensation program, based upon an extensive analysis of comparative data, including director compensation at companies in the peer group used for executive compensation purposes. Farient concluded that the company’s director compensation was below market, particularly in the equity component of the program, when compared with the peer group and the broader benchmark of comparably sized companies.

Based upon its review, including the information Farient provided, the Governance Committee recommended that the board of directors approve changes to the direc-

tor compensation program. The Governance Committee recommended that thetargets director compensation levelto be set at aboutapproximately the 50th percentile of the total compensation in the peer and broader benchmark groups. The board of directors approved the changes to the compensation program, subject to approval by our stockholders of an amendedgroups and restated Directors’ Stock Plan atused that benchmark in establishing the 2014 Annual Meeting. No new shares were requested or authorized to satisfy awards under the amended and restated Directors’ Stock Plan. The revised board compensation program became effective on May 12, 2014, when the company’s stockholders approved the amended and restated Directors’ Stock Plan.levels.

Highlights of the 2014 Changes to the Directors’ Compensation Program are:Program:

Directors’ Fees

Each non-employee director receives an annual retainer of $75,000 for board service and an additional retainer for service on the committees to which he or she is assigned. The Non-Executive Chairman of the Board receives an additional retainer of $100,000 commensurate with the additional responsibilities required of the chairman role.

Annual retainers for committee service are: $12,000 for service on the Audit Committee (with the Committee Chairman receiving an additional annual retainer of $12,000); $10,500 for service on the Executive Compensation Committee (with the Committee Chairman receiving an additional annual retainer of $10,500);

$9,000 for service on the Governance Committee (with the Committee Chairman receiving an additional annual retainer of $9,000); and $9,000 for service on the Finance Committee (with the Committee Chairman receiving an additional annual retainer of $9,000).

A meeting attendance fee of $2,000 is paid with respect to meetings of the Executive Committee. The Executive Committee did not meet in 2014.

Directors’ Fees

As noted above, beginning May 12, 2014, meeting attendance fees were discontinued. Instead, the annual retainer for board service was increased to $75,000 and each non-employee director also receives an additional retainer for service on the committees to which he or she is assigned. The annual retainers for board and committee service were prorated from the effective date of the new program to the end of the calendar year. The non-executive chairman of the board receives an additional retainer of $100,000 commensurate with the additional responsibilities required of the chairman role.

Annual retainers for committee service under the revised compensation program are: $12,000 for service on the Audit Committee (with the committee chairman receiving an additional annual retainer of $12,000); $10,500 for service on the Executive Compensation Committee (with the committee chairman receiving an additional annual retainer of $10,500); $9,000 for service on the Governance Committee (with the committee chairman receiving an additional annual retainer of $9,000); and $9,000 for service on the Finance Committee (with the

committee chairman receiving an additional annual retainer of $9,000).

For 2014 service prior May 12, 2014, non-employees were compensated under the previous director compensation program. For that period, each director who was not an employee received an annual retainer of $65,000 and a meeting fee of $1,500 for each board and committee meeting attended. Committee chairs (except for the Audit Committee chair) received an additional $1,500 for each committee meeting that they chaired, and the Audit Committee chair received an additional $2,000 for each Audit Committee meeting chaired. The Non-Executive Chairman received an additional annual retainer of $50,000. All cash retainers paid in 2014 under the previous compensation program were prorated for the portion of the calendar year covered by the previous program.2017.

All directors are reimbursed for their out-of-pocket expenses incurred in attending board and committee meetings.

Stock under the Revised DirectorDirector’s Compensation Program

Under the amended and restated Directors’ Stock Plan, each non-employee director who was not an employee of the company received an award of restricted stock units with a fair market value of $100,000 on the date of grant, which are fully vested one year after the date of grant. (Directors appointed by the board to fill a vacancy during the year receive a prorated grant of restricted stock units as

described in the Directors’ Stock Plan.) The units have no voting rights until they are converted to shares of common stock. Each non-employee director receives a quarterly cash payment equal to the amount that would have been paid

as a dividend with respect to shares represented by the restricted stock units held as of the

CORPORATE GOVERNANCE

record date for the payment of the common stock dividend. Non-employee directors may elect to defer the conversion of restricted stock units to shares until the date of termination of service as a director.

Shares shown in the table on page 2117 of this proxy statement disclosing security ownership of directors and executive officers include shares granted to the directors under the Directors’ Stock Plan.

| 14 |

CORPORATE GOVERNANCE

Director Stock Ownership Requirement

The board of directors maintains directors’ stock ownership guidelines, requiring, among other things, that each director accumulate and retain a minimum of Companycompany common stock with a market value of five times the base retainer, or $375,000, within five years of becoming a director of Pitney Bowes. All members of the board

of directors are in compliance with these guidelines. The directors’

stock ownership guidelines are available within the Governance Principles on our Corporate Governance website atwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance.”

A comparison of the revised directors’ compensation program and the previous program is shown in the table below.

COMPARISON OF REVISED AND PREVIOUS DIRECTOR COMPENSATION PROGRAMS

| Incremental Leadership | ||||||||||||||||||

| Board Member | Premiums | |||||||||||||||||

| Compensation Element | Revised | Previous | Revised | Previous | ||||||||||||||

| Board service | (Board Chairman) | |||||||||||||||||

| Cash retainer | $75,000 | $65,000 | $100,000 | $50,000 | ||||||||||||||

| Meeting fee | $0 | $1,500 | $0 | $0 | ||||||||||||||

| Equity Award | $100,000 | |||||||||||||||||

| value-based grant | 2,200 shares | |||||||||||||||||

| Annual Equity Grant | ||||||||||||||||||

| Committee service | Committee | |||||||||||||||||

| Cash retainer | Chairmen | |||||||||||||||||

| • Audit | $12,000 | $0 | $12,000 | $0 | ||||||||||||||

| • Executive Compensation | $10,500 | $0 | $10,500 | $0 | ||||||||||||||

| • Governance | $9,000 | $0 | $9,000 | $0 | ||||||||||||||

| • Finance | $9,000 | $0 | $9,000 | $0 | ||||||||||||||

| Meeting Fee | ||||||||||||||||||

| • Audit | $0 | $1,500 | $0 | $2,000 | ||||||||||||||

| • Executive Compensation | $0 | $1,500 | $0 | $1,500 | ||||||||||||||

| • All Other Committees | $0 | $1,500 | $0 | $1,500 | ||||||||||||||

| Total Compensation | @$195,000 | @$125,000 | ||||||||||||||||

| Ownership Guidelines | 5 times cash retainer; | 7,500 shares; | ||||||||||||||||

| 5 years to reach | 5 years to reach | |||||||||||||||||

| compliance | compliance | |||||||||||||||||

Directors’ Deferred Incentive Savings Plan

We maintain a Directors’ Deferred Incentive Savings Plan under which directors may defer all or part of the cash portion of their compensation. Deferred amounts will be notionally “invested” in any combination of severalsev-

eral institutional investment funds. The investment choices available to directors under this plan are the same as those offered to employees under the company’s 401(k) plan.

Directors’ Equity Deferral Plan

Directors may elect to defer all of their equity portion of their compensation on an annual basis. Deferral of restricted stock units (RSU) defers settlement of the RSUs into company common stock until termination from board service. RSU awards, whether deferred or not, vest on the first anniversary of the award. Deferred

RSUs continue to receive dividend equivalents. Deferred RSUs do not have any voting rights until converted into common stock. Deferred RSUs are converted into company common stock upon the expiration of 90 days following termination of board service.

Directors’ Retirement Plan

The board discontinued the Directors’ Retirement Plan, with all benefits previously earned by directors frozen as of May 12, 1997.

Linda G. Alvarado is the only current director who is eligible to receive a retirement benefit under the plan

after termination of service on the board of directors. As of

the date the plan was frozen, she had completed five years of service as a director, the minimum years of service required to receive an annual retirement benefit of 50% of her retainer as of May 12, 1997. Therefore, she will receive an annual benefit of $15,000.$15,000 after termination from board service.

CORPORATE GOVERNANCE

DIRECTOR COMPENSATION FOR 20142017

| Change in | |||||||||||||||||

| Pension Value | |||||||||||||||||

| and Nonqualified | |||||||||||||||||

| Fees Earned or | Stock | Deferred | All Other | ||||||||||||||

| Paid in Cash | Awards | Compensation | Compensation | ||||||||||||||

| Name | ($)(1) | ($)(2) | Earnings ($)(3) | ($)(4)(5) | Total ($) | ||||||||||||

| Linda G. Alvarado | 91,500 | 100,000 | 32,780 | 7,147 | 231,427 | ||||||||||||

| Anne M. Busquet | 92,437 | 100,000 | 0 | 7,147 | 199,584 | ||||||||||||

| Roger Fradin | 90,375 | 100,000 | 0 | 7,147 | 197,522 | ||||||||||||

| Anne Sutherland Fuchs | 95,812 | 100,000 | 0 | 7,147 | 202,959 | ||||||||||||

| S. Douglas Hutcheson | 93,375 | 100,000 | 0 | 2,147 | 195,522 | ||||||||||||

| Eduardo R. Menascé | 102,000 | 100,000 | 0 | 2,147 | 204,147 | ||||||||||||

| Michael I. Roth | 184,750 | 100,000 | 0 | 7,147 | 291,897 | ||||||||||||

| David L. Shedlarz | 106,875 | 100,000 | 0 | 7,147 | 214,022 | ||||||||||||

| David B. Snow, Jr. | 101,063 | 100,000 | 0 | 2,147 | 203,210 | ||||||||||||

| Change in | ||||||||||||||||

| Pension Value | ||||||||||||||||

| and Nonqualified | ||||||||||||||||

| Fees Earned or | Stock | Deferred | All Other | |||||||||||||

| Paid in Cash | Awards | Compensation | Compensation | |||||||||||||

| Name | ($)(1) | ($)(2) | Earnings ($)(3) | ($)(4) | Total ($) | |||||||||||

| Linda G. Alvarado | 93,000 | 100,000 | 15,590 | 10,965 | 219,555 | |||||||||||

| Anne M. Busquet | 94,500 | 100,000 | 0 | 10,965 | 205,465 | |||||||||||

| Roger Fradin | 96,000 | 100,000 | 0 | 4,577 | 200,577 | |||||||||||

| Anne Sutherland Fuchs | 94,500 | 100,000 | 0 | 4,577 | 199,077 | |||||||||||

| S. Douglas Hutcheson | 96,000 | 100,000 | 0 | 13,827 | 209,827 | |||||||||||

| Eduardo R. Menascé | 105,000 | 100,000 | 0 | 13,827 | 218,827 | |||||||||||

| Michael I. Roth | 205,000 | 100,000 | 0 | 7,077 | 312,077 | |||||||||||

| Linda S. Sanford | 97,500 | 100,000 | 0 | 4,577 | 202,077 | |||||||||||

| David L. Shedlarz | 108,000 | 100,000 | 0 | 7,880 | 215,880 | |||||||||||

| David B. Snow, Jr. | 103,500 | 100,000 | 0 | 10,525 | 214,025 | |||||||||||

| (1) | |

| (2) | Represents the grant date fair value of |

| (3) | Ms. Alvarado is the only non-employee director who served on the board of directors during |

| (4) | |

| During | |

| board member per calendar year. For Mr. Roth, the amount shown in this column includes a company match of $2,500 made in 2017. |

CORPORATE GOVERNANCE

Relationships and Related-Person Transactions

The board of directors has a written “Policy on Approval and Ratification of Related-Person Transactions” which states that the Governance Committee is responsible for reviewing and approving any related person transactions between Pitney Bowes and its directors, nominees for director, executive officers, beneficial owners of more than five percent of any class of Pitney Bowes voting stock and their “immediate family members” as defined by the rules and regulations of the SEC (related persons).

Under the related-person transaction approval policy, any newly proposed transaction between Pitney Bowes and a related person must be submitted to the Governance Committee for approval if the amount involved in the transaction or series of transactions is greater than $120,000. Any related-person transactions that have not been pre-approved by the Governance Committee must be submitted for ratification as soon as they are identified. Ongoing related-person transactions are reviewed on an annual basis. The material facts of the transaction and the related person’s interest in the transaction must be disclosed to the Governance Committee. It is the

expectation and policy of the board of directors that any related-person transactions will be at arms’ length and on terms that are fair to the company.

If the proposed transaction involves a related person who is a Pitney Bowes director or an immediate family member of a director, that director may not participate in the deliberations or vote regarding approval or ratification of the transaction but may be counted for the purposes of determining a quorum.

The following related-person transactions do not require approval by the Governance Committee:

| 1. | Any transaction with another company with which a related person’s only relationship is as an employee |

| or beneficial owner of less than ten percent of that company’s shares, if the aggregate amount invested does not exceed the greater of $1 million or two percent of that company’s consolidated gross revenues; | ||

| 2. | A relationship with a firm, corporation or other entity that engages in a transaction with Pitney Bowes where the related person’s interest in the transaction |

| 16 |

CORPORATE GOVERNANCE

| arises only from his or her position as a director or limited partner of the other entity that is party to the transaction; |

| 3. | Any charitable contribution by Pitney Bowes to a charitable organization where a related person is an officer, director or trustee, if the aggregate amount involved does not exceed the greater of $1 million or two percent of the charitable organization’s consolidated gross revenues; |

| 4. | Any transaction involving a related person where the rates or charges involved are determined by competitive bids; and |

| 5. | Any transaction with a related person involving services as a bank depositary of funds, transfer agent, |

| registrar, trustee under a trust indenture, or similar services. |

The Governance Committee may delegate authority to approve related-person transactions to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any approval or ratification decisions to the Governance Committee at its next scheduled meeting.

During 2014, no transactions were submitted toStanley J. Sutula, III, Executive Vice President and Chief Financial Officer, is an executive officer of the Governance Committee for review.company. His brother, Troy Sutula, holds the position of Vice President, Parcel Services—Presort Services. The value of Troy Sutula’s annual compensation is approximately $255,450.

Compensation Committee Interlocks and Insider Participation

During 2014,2017, there were no compensation committeeExecutive Compensation Committee interlocks and no insider participation in Executive Compensation Committee decisions that were required to be reported under the rules and regulations of the Securities Exchange Act of 1934, as amended.

CORPORATE GOVERNANCE

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

| Shares | Options | ||||||||||||

| Title of | Deemed to | Exercisable | |||||||||||

| Class of | be Beneficially | Within | |||||||||||

| Stock | Name of Beneficial Owner | Owned(1)(2)(3)(4) | 60 Days(4) | % of Class | |||||||||

| Common | Linda G. Alvarado | 37,428 | 0 | * | |||||||||

| Common | Anne M. Busquet | 15,882 | 0 | * | |||||||||

| Common | Roger Fradin | 9,997 | 0 | * | |||||||||

| Common | Anne Sutherland Fuchs | 18,763 | 0 | * | |||||||||

| Common | S. Douglas Hutcheson | 9,256 | 0 | * | |||||||||

| Common | Eduardo R. Menascé | 24,092 | 0 | * | |||||||||

| Common | Michael I. Roth | 39,170 | 0 | * | |||||||||

| Common | David L. Shedlarz | 25,892 | 0 | * | |||||||||

| Common | David B. Snow, Jr. | 17,800 | 0 | * | |||||||||

| Common | Marc B. Lautenbach | 615,827 | 500,000 | * | |||||||||

| Common | Michael Monahan | 735,249 | 635,052 | * | |||||||||

| Common | Mark L. Shearer | 25,334 | 0 | * | |||||||||

| Common | Daniel J. Goldstein | 74,344 | 39,855 | * | |||||||||

| Common | Abby F. Kohnstamm | 28,414 | 0 | * | |||||||||

| Common | All executive officers and directors as a group (17) | 2,091,272 | 1,474,946 | 1.03 | % | ||||||||

| Shares | Options | |||||||||||||||

| Title of | Deemed to | Exercisable | ||||||||||||||

| Class of | be Benefically | Within | ||||||||||||||

| Stock | Name of Beneficial Owner | Owned(1)(2)(3)(4) | 60 days(4) | % of Class | ||||||||||||

| Common | Linda G. Alvarado | 51,633 | 9,888 | * | ||||||||||||

| Common | Anne M. Busquet | 30,087 | 9,888 | * | ||||||||||||

| Common | Roger Fradin | 24,863 | 0 | * | ||||||||||||

| Common | Anne Sutherland Fuchs | 33,629 | 0 | * | ||||||||||||

| Common | S. Douglas Hutcheson | 27,960 | 13,704 | * | ||||||||||||

| Common | Eduardo R. Menascé | 37,796 | 13,704 | * | ||||||||||||

| Common | Michael I. Roth | 54,480 | 0 | * | ||||||||||||

| Common | Linda S. Sanford | 25,387 | 0 | * | ||||||||||||

| Common | David L. Shedlarz | 40,341 | 4,403 | * | ||||||||||||

| Common | David B. Snow, Jr. | 31,920 | 9,301 | * | ||||||||||||

| Common | Marc B. Lautenbach | 1,816,519 | 1,575,344 | * | ||||||||||||

| Common | Michael Monahan | 1,230,345 | 1,040,317 | * | ||||||||||||

| Common | Roger Pilc | 108,795 | 68,380 | * | ||||||||||||

| Common | Mark L. Shearer | 150,097 | 61,248 | * | ||||||||||||

| Common | Stanley J. Sutula III | 187,881 | 187,881 | * | ||||||||||||

| Common | All executive officers and directors as a group (22) | 4,777,626 | 3,685,778 | 2.50 | % | |||||||||||

| * | Less than 1% of Pitney Bowes Inc. common stock. | ||

| (1) | These shares represent common stock beneficially owned as of March 1, | ||

| (2) | Other than with respect to ownership by family members, the reporting persons have sole voting and investment power with respect to the shares listed. | ||

| (3) | Includes shares that are held indirectly through the Pitney Bowes 401(k) Plan. | ||

| (4) | The director or executive officer has the right to acquire beneficial ownership of this number of shares within 60 days of March 1, | ||

| (5) | Mr. Lautenbach’s total includes three open market purchases of company stock using his personal funds: (i) 4,739 shares (approximately $70,015) made in November 2016 (ii) 12,007 shares (approximately $250,000) made in October 2015 and (iii) 66,000 shares (approximately $1,000,000) made in May 2013. | ||

CORPORATE GOVERNANCE

The only persons or groups known to the company to be the beneficial owners of more than five percent of any class of the company’s voting securities are reflected in the chart below. The following information is based solely upon Schedules 13G and amendments thereto filed by the entities shown with the SEC as of the date appearing below.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership of Common Stock | Percent of Common Stock(1) | ||

| The Vanguard Group, Inc. 100 Vanguard Blvd Malvern, PA 19355 | ||||

| 8.63% |

| (1) | There were |

| (2) | As of |

| As of | |

Section 16(a) Beneficial Ownership Reporting Compliance